What the Argentina bailout is really about

Even though Halloween has passed I have a ghost story to tell.

The US government is providing $20 billion in emergency assistance to Argentina through a currency swap and another $20 billion in private financing under discussion. The official narrative is emphasizes supporting President Milei's free-market reforms and countering Chinese influence in Latin America. However if you follow the money, it becomes obvious this is not a bailout of Argentina, but foreign bond holders.

Treasury Secretary Scott Bessent announced a $20 billion currency swap line using the Exchange Stabilization Fund. This came after Argentina's peso plummeted 26% during 2025, with particularly sharp declines in October threatening a new default. The assistance package also includes $20 billion IMF facility approved in April 2025, bringing total potential support to $40-$60 billion.

The official narrative is supporting Milei's free-market reforms and Chinese influence. Bessent praised Milei as a "beacon" and said the US would "do whatever it takes to support Argentina." However, evidence reveals a more cynical reality; this bailout enriches wealthy bondholders while leaving Argentina no better off. To understand why, we need to look at what happened in the East Asian Financial Crisis in 1997-98.

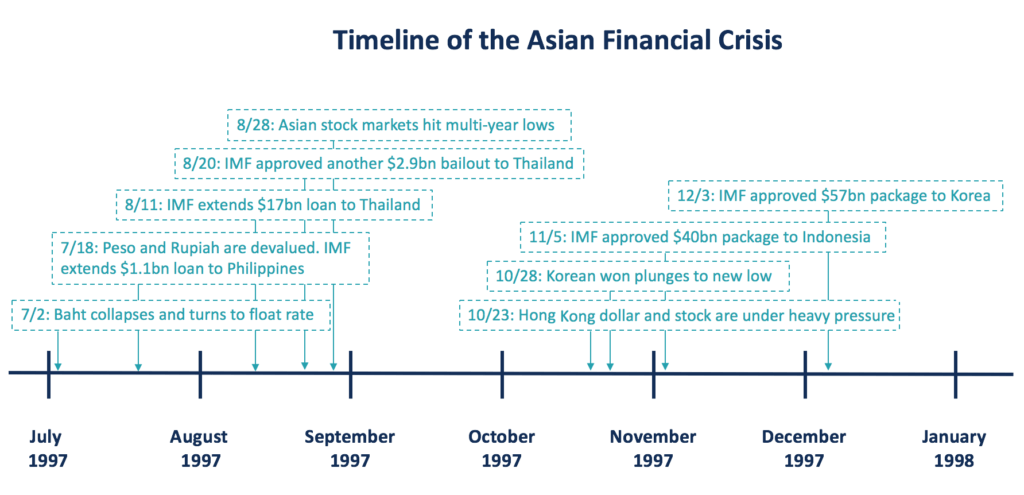

The Asian Financial Crisis Precedent

In 1997-98 a devastating financial crisis swept through East and Southeast Asia, causing currency collapses, bank failures, and severe recessions in high-growth "tiger economies" like Thailand, Indonesia, and South Korea. The IMF provided massive bailouts totaling $118 billion ($20 billion to Thailand, $40 billion to Indonesia, and $58 billion to South Korea). Like Argentina, these countries had accumulated large foreign-currency debts, particularly dollar and yen-denominated short-term loans. The primary creditors were the Japanese Banks along with US and European banks.

On December 24th 1997, the Federal Reserve Bank of New York hosted a meeting where US banks with the largest exposures to South Korean banks "voluntarily committed to roll over their short-term loans, and to work with South Korean authorities to restructure them into medium-term loans.". The US government directly organized a meeting to protect US bank creditors from losses. South Korea was days away from default with foreign reserves nearly exhausted. Instead of letting the creditors take the losses, the Fed facilitated a rollover agreement that protected the Western banks while South Korea took on $58 billion in IMF debt with harsh conditions. In other words, the IMF debt protected Western banks at the expense of the South Korean people. As soon as the IMF money flowed into South Korea and other Asian countries, it left the countries almost immediately flowing to Western banks.

A 1998 Congressional Research Service report documented "IMF assistance to the above three countries has been criticized for 'bailing out' commercial banks and private investors at the expense of other less-favored groups and US taxpayers." The IMF's defense? Exactly what bailout advocates say about Argentina: the funds support "economy wide, structural imbalances" not specific investors. The report notes "There is little doubt that banks which have loans outstanding in Asia have much to gain by returning to stability in financial markets there. "

Argentina's Debt Structure and Bondholders

The comparison with what happened then with Argentina now is striking. Approximately 56% of Argentina's public debt (roughly $200 billion) is denominated in foreign currency, primarily the US dollar. This creates a structural problem as Argentina must earn dollars through exports to service debt, but cannot print dollars when crisis hits.

The Argentina bondholders are predominantly US institutions. Major US holders include BlackRock, PIMCO, Fidelity, and Franklin Templeton. These bonds have been volatile and costly for some of these investors. PIMCO, for example, lost at least 33% on their Argentine holdings between September 2020's restructuring and 2023. Sophisticated hedge funds bought this distressed debt at 20-30 cents on the dollar and stand to profit enormously from this 2025 bailout. When the bailout was announced, Argentine sovereign bonds rallied immediately enriching precisely these investors.

The Citrone Connection

The most damning evidence that this bailout is about enriching bondholders while leaving ordinary Argentines no better off involves Rob Citrone, a billionaire hedge fund manager at Discovery Capital Management. Citrone purchased Argentine bonds at high interest rates even as the economy was deteriorating, despite Argentina's default history. His bet paid off spectacularly. Citrone and Bessent worked together at Soros Fund Management, where they collaborated on highly profitable currency trades, including a 2013 dollar-yen position that generated over $1 billion.

According to multiple Argentine media outlets, Citrone contacted Bessent regarding Argentina in the weeks before the bailout announcement, though these reports remain unconfirmed by US sources. The New York Times reported the two were "in close contact" in the lead-up to the Treasury announcement. When asked to comment on these reports, Discovery Capital declined. The timing raised questions: According to Popular Information and Argentine media reports, Citrone purchased additional Argentine bonds in early September 2025, approximately two weeks before Bessent announced the bailout.

Congressional members are examining whether the bailout enriched Bessent's Wall Street associates, with multiple oversight letters demanding transparency about potential conflicts of interest. Bessent has deep connections in the financial industry and longtime associates who made large, profitable bets on Argentina.

Following the Money

Similar to the East Asia Financial crisis in the 90s, which bailout out Western banks, this Argentina bailout follows the same pattern. Money in the forms of IMF loans will flow into Argentina and immediately leave, bailing out Western bondholders like Bessent's Wall Street associates. As with most economic news, the key question is: Cui bono? Who benefits?

Sources

Yesterday, @POTUS and I spoke extensively with President @JMilei and his senior team in New York. As President Trump has stated, we stand ready to do what is needed to support Argentina and the Argentine people.

— Treasury Secretary Scott Bessent (@SecScottBessent) September 24, 2025

Under President Milei, Argentina has taken important strides… https://t.co/TlzvkbNxII

https://finance.yahoo.com/news/trump-argentina-bailout-bessent-old-182939163.html

The @USTreasury has concluded 4 days of intensive meetings with Minister @LuisCaputoAR and his team in DC. We discussed Argentina’s strong economic fundamentals, including structural changes already underway that will generate significant dollar-denominated exports and foreign…

— Treasury Secretary Scott Bessent (@SecScottBessent) October 9, 2025

https://democrats-financialservices.house.gov/uploadedfiles/10.16.2025_bessent_esf_argentinab.pdf